The requirement to automatically enrol (AE) eligible employees into a qualifying workplace pension applies from a company’s ‘staging date’. This date is determined by the Department for Work and Pensions according to the number of employees within a company’s PAYE scheme – with the largest companies staging back in October 2012 followed, in stages, by medium and small companies.

Experian’s staging date was 1 May 2013., Eligible employees were automatically enrolled in to the Experian Retirement Savings Plan (ERSP) on 1 August 2013 following a 3 months postponement period (as permitted under the AE requirements).

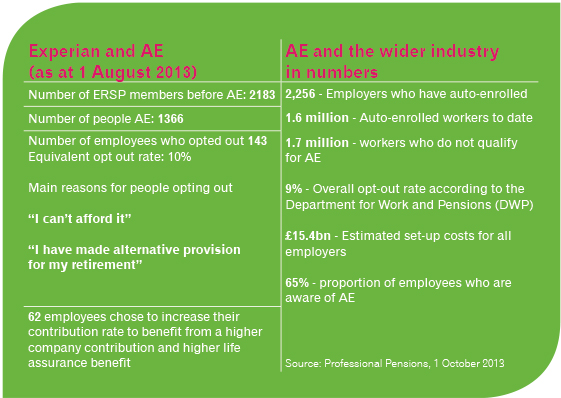

Here’s an update on Experian’s AE journey to date.

First, a reminder of what AE is all about:

- New pensions legislation introduced by the Government to address the fact that people aren’t saving enough money during their working life to secure the income they are likely to want - and need – in retirement, when life expectancy in the UK continues to improve;

- A requirement for all UK employers to provide a workplace pension for their employees, who:

- are aged between 22 and State Pension age

- earn more than £10,000 a year

- are ordinarily working in the UK

- A requirement for those employers to make a minimum contribution to its workplace pension for eligible employees, unless they choose to opt out of enrolment, in which case eligible employees must be re-enrolled every 3 years (following which they can choose to opt out again if they wish).

Experian already provided a competitive workplace pension which employees could choose to join voluntarily, but a significant amount of work was needed to adapt our existing processes, systems and communications for automatic enrolment in advance of our staging date. Experian also reduced the minimum employee contribution rate from 3% to 2% of pensionable pay to make the ERSP more affordable for everyone.

Only a minority of employees who were auto enrolled in August chose to opt out of the ERSP (143 from a total of 1,366 - an equivalent opt out rate of around10%), therefore most Experian employees now benefit from a competitive workplace pension and a valuable contribution from Experian.

A total of 314 employees who weren’t eligible to be automatically enrolled chose to join (opt in to) the ERSP in August, and 62 employees chose to increase their pension contributions above the minimum required level in order to maximise Experian’s contribution.

Here’s a reminder of the contribution options and associated life assurance benefit. Contributions are expressed as a percentage of your pensionable pay.

|

Your contribution

|

Experian contribution

|

Total pension contribution

|

Life assurance benefit(multiple of basic salary)

|

|

2%

|

4%

|

6%

|

2 times

|

|

3%

|

7%

|

10%

|

4 times

|

|

4%

|

8%

|

12%

|

4 times

|

|

5%

|

10%

|

15%

|

4 times

|

AE in numbers…….

Now you’ve been auto enrolled and enjoy the benefits of a competitive workplace pension, you might want to think about:

- maximising your contributions to make sure you get full benefit from the ERSP

- paying additional voluntary contributions on top of the basic contributions set out in the table above to further increase your retirement savings. Please note, if you pay voluntary contributions, Experian’s maximum contribution will not exceed 10% of your pensionable pay

- reviewing your investment options

- reviewing your target retirement age and income plans as you get closer to retirement to ensure that you remain on track

For more information about AE or the ERSP visit www.experian.co.uk/retirement plan.

Thanks for reading!