From 6 April 2016 the limits for tax-free retirement savings are changing.

Most members of the Experian Retirement Savings Plan (ERSP) are unlikely to be affected by the changes, but you are responsible for your own tax position so it's important that you understand them.

Read on to ensure you understand the changes and the impact they may have on you, whether now or in the future.

In summary, the changes will introduce:

For contributing ERSP members

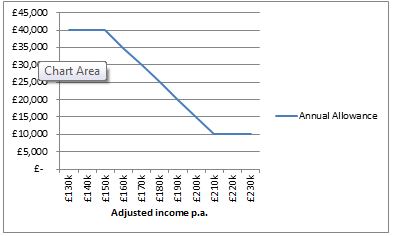

- A lower Annual Allowance (AA) for tax-free retirement savings of between £10,000-£40,000 each tax year if your total “adjusted income” exceeds £150,000 a year. Adjusted income includes your total taxable income (including variable items such as bonus, commission and any non-Experian taxable income), plus pension/retirement savings made by you and Experian during the tax year (including any savings in personal pensions outside of Experian). As shown in the graph below, for every £2 your adjusted income exceeds £150,000, your AA will be reduced by £1, down to a minimum level of £10,000 for those with an adjusted income of £210,000 or more.

For all ERSP members

- A lower Money Purchase Annual Allowance (MPAA) for tax-free retirement savings of £10,000 a year will apply if you have taken some of your retirement savings with Experian, a previous employer or personal pension plan using the new retirement flexibilities introduced by the government in April 2015. You need to let us (and any other retirement plans that you’re a member of) know if the MPAA applies to you, otherwise you will be subject to a fine from HMRC.

- The Lifetime Allowance (LTA) for total tax-free savings at retirement is reducing from £1.25m to £1m, and could affect you if you’ve built up substantial savings from all of your retirement arrangements (including previous employments and personal pensions). If your total retirement savings are likely to exceed £1m at April 2016 then you might want to consider applying to HMRC for protection against the change.

If you’re impacted now or in the future, and fail to act, you could be liable for a substantial personal tax charge on any retirement savings above the AA, MPAA and LTA.

For AA purposes if you have any unused tax relief to carry forward from the previous three tax years this can be used to mitigate the charge. This carry forward option does not apply for the MPAA.

We won’t know if you’re affected by the changes as it depends on your personal circumstances and your taxable income each year (which includes non-Experian taxable income). In view of the variable nature of certain earnings, such as bonus and commission, it may also be difficult for you to accurately predict whether or not you will be impacted each year.

It is therefore important that you understand these changes, any action that you may need to take each year, and who to speak to if you need further help.

If you are unsure whether these changes affect you, you may need to seek professional tax or financial advice.

Further detailed guidance will be emailed to all contributing members and uploaded to this website early in 2016, once Experian has decided what options will be made available to affected members from April 2016.

In the meantime you can find out more about the tax changes by visiting the following websites once they’ve been updated to reflect the changes:

www.hmrc.gov.uk (‘tax on your private pension contributions’ section)

www.pensionsadvisoryservice.org.uk (‘saving into a pension’ section)

www.moneyadviceservice.org.uk (‘saving for retirement’ section)