Important information about your 2020 Experian Retirement Savings Plan Statement

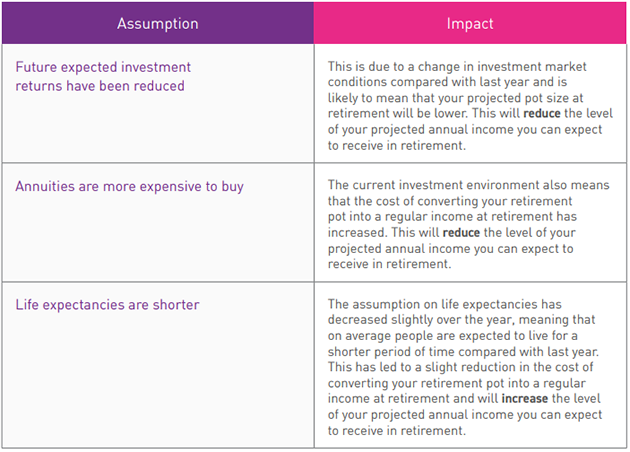

Changes in the assumptions used to calculate your benefit projections mean that your retirement projections have changed (most likely downwards) compared to your last year’s statement. More details on the key reasons for the changes, and the impact they could have on your projections is summarised in the table below:

The table above highlights that the three key assumptions may either increase or decrease your projection of benefits, but the overall effect is generally negative, and so you may see a reduction of between 5-15% in your annual projection in 2020.

These reductions may be offset in individual cases by the addition of contributions paid into your retirement pot over the year.

Coronavirus impact on your retirement savings

We’ve all heard on the news about the falls in stock markets as a result of the coronavirus. On the back of this, you may have seen falls in the value of the retirement savings (and hence projections)

that you have in the Plan. The impact of the falls in investment markets on your retirement savings will depend on where your savings are invested and how close you are to your selected retirement age.

Where your savings are invested will depend on whether you made your own investment choice on

joining the Plan. If you made your own choice then you can visit www.experian.co.uk/retirementplan to monitor fund performance on your selected investment fund(s).

If you haven’t made an investment choice, then you’ll be invested in the ‘Lifestyle Option’. Read on for details about how this affects members of different ages.

Younger ERSP members in the ‘Lifestyle Option’

If you haven’t made a choice about where your retirement savings should be invested, your savings are automatically invested in the ‘Lifestyle Option’. If you’re more than 20 years away from your selected Target Retirement Age, your savings will be fully invested in equities, i.e. company shares, around the world.

Retirement is a long way off for you, so although stock markets have fallen, there should be time for markets to recover. When prices are lower, your monthly contributions are buying more units in funds in which you’re investing.

We would therefore encourage you to view your retirement savings as a long-term arrangement and think carefully before making any sudden investment changes.

ERSP Members who are closer to retirement in the ‘Lifestyle Option’

If you’re within 20 years of your selected Target Retirement Age (TRA), and haven’t made a choice about where to invest your retirement savings, your savings will already have started automatically to be moved out of company shares under the ‘Lifestyle Option’, and invested in a way that starts to give your savings greater protection against changes in stock markets.

As retirement approaches, we understand that you may increasingly want to reduce the level of volatility with your retirement savings to provide more certainty as to the value of your savings. That’s why they’re invested in a range of different types of investment, with a higher proportion of your savings in investments that don’t go up and down as much as company shares.

The closer you are to your selected TRA, the greater the proportion of your savings that will be invested in these less volatile funds. This means that any fall in your savings will be more limited.

If you’re within 3 years of your selected TRA, some of your retirement savings will already be invested in cash. You may have seen some fall in the value of your other savings though, so it’s worth checking this out to see what it means for you.

Important reminder about your selected ‘Target Retirement Age’

If your retirement savings are invested in the Lifestyle Option or the Adventurous Lifestyle Option, you should remember that your investment allocations will be adjusted year by year, in the 20 and 10 years, respectively, leading up to your selected Target Retirement Age (TRA).

It is therefore important to consider whether your selected TRA is in line with when you expect to retire. You can find details of your current selected TRA in your annual benefit statement. If you wish to change your selected TRA you should contact the Plan’s Administrator.

Download a copy here