Lifestyle options - investment strategy five years before retirement

When you are around five years from your planned Target Retirement Age (TRA) we'll ask you to tell us whether you plan to take your savings as cash, income drawdown, an annuity or as a combination of all three. How your retirement savings are invested in the last five years before your TRA will depend on how you plan to take your savings.

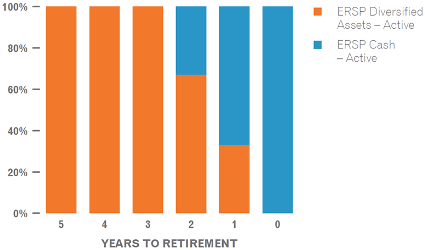

Cash option - if you plan to take your savings as cash, you can choose the cash option. Your savings will be switched into the Cash fund gradually over the three years before your TRA.

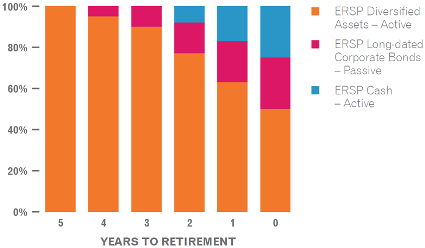

Drawdown option - if you plan to take some of your savings as cash but drawdown the rest, you can choose the Drawdown option. Your savings will be gradually switched into a mix of funds which are more appropriate for the drawdown option five years before your TRA.

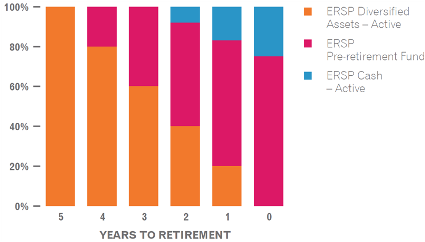

Annuity option - if you plan to take some of your savings as cash and buy an annuity with the rest, you can choose the Annuity option. Your savings will be gradually switched into a mix of funds which are more appropriate for the annuity option five years before TRA.

You will have the option to invest in one or more of the above Lifestyle strategies. The benefit choices you make will significantly impact how your retirement savings are invested before you retire.