What if I don't make a choice?

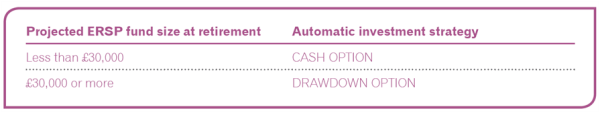

If you don’t tell us your choice when you are five years from retirement, your retirement savings will be automatically defaulted to a strategy based on your projected Plan savings at Target Retirement Age (TRA) as follows:

You should note that this projection is based only on your funds within this Plan and doesn’t take into account any retirement savings you may have with previous employers or other arrangements.

You may therefore have other significant retirement savings which mean that the automatic default strategy is not appropriate for you, in which case you should make sure you tell us how you intend to use your Plan savings, to ensure that they’re appropriately invested in the run up to your retirement.

You should also bear in mind that the automatic default investment strategy is not revisited in the run up to your retirement even if you commence additional contributions or transfer in savings from other arrangements which would affect your projected Plan savings at retirement. It is therefore important that you keep your investment choice under review, particularly if your circumstances change.

You must ensure that your TRA remains appropriate. You can make changes online at www.experian.co.uk/retirementplan or by contacting the Experian Pensions team at Capita on 0114 229 8273 or at experianpensions@capita.co.uk.